All Categories

Featured

Table of Contents

One of the essential aspects of any kind of insurance plan is its cost. IUL policies frequently come with various charges and charges that can impact their general worth.

Pay particular attention to the policy's functions which will be vital depending upon how you desire to utilize the policy. Talk to an independent life insurance policy agent that can aid you choose the finest indexed universal life plan for your demands.

Testimonial the plan carefully. If satisfying, return signed delivery invoices to obtain your universal life insurance policy protection in force. Make your first costs settlement to trigger your plan. Since we've covered the advantages of IUL, it's important to understand just how it contrasts to other life insurance policy policies readily available in the market.

By understanding the similarities and differences between these policies, you can make an extra informed decision concerning which sort of life insurance policy is finest fit for your needs and financial objectives. We'll start by contrasting index universal life with term life insurance policy, which is typically thought about one of the most uncomplicated and inexpensive sort of life insurance coverage.

Can I get Indexed Universal Life Accumulation online?

While IUL might supply higher potential returns as a result of its indexed money worth development mechanism, it also comes with greater costs compared to call life insurance policy. Both IUL and whole life insurance policy are sorts of long-term life insurance plans that provide death advantage protection and cash money value development possibilities (IUL loan options). There are some essential differences in between these 2 types of policies that are important to consider when deciding which one is best for you.

When taking into consideration IUL vs. all other kinds of life insurance policy, it's essential to evaluate the pros and disadvantages of each plan type and talk to a knowledgeable life insurance policy representative or monetary adviser to establish the ideal alternative for your one-of-a-kind requirements and financial goals. While IUL uses several advantages, it's additionally vital to be aware of the risks and considerations related to this type of life insurance policy policy.

Allow's dig deeper into each of these threats. Among the key problems when taking into consideration an IUL plan is the different costs and fees connected with the plan. These can consist of the expense of insurance policy, plan charges, surrender costs and any kind of additional biker expenses incurred if you add added benefits to the policy.

You want an IUL policy with an array of index fund options to fulfill your requirements. An IUL plan need to fit your specific circumstance.

Why is Iul Retirement Planning important?

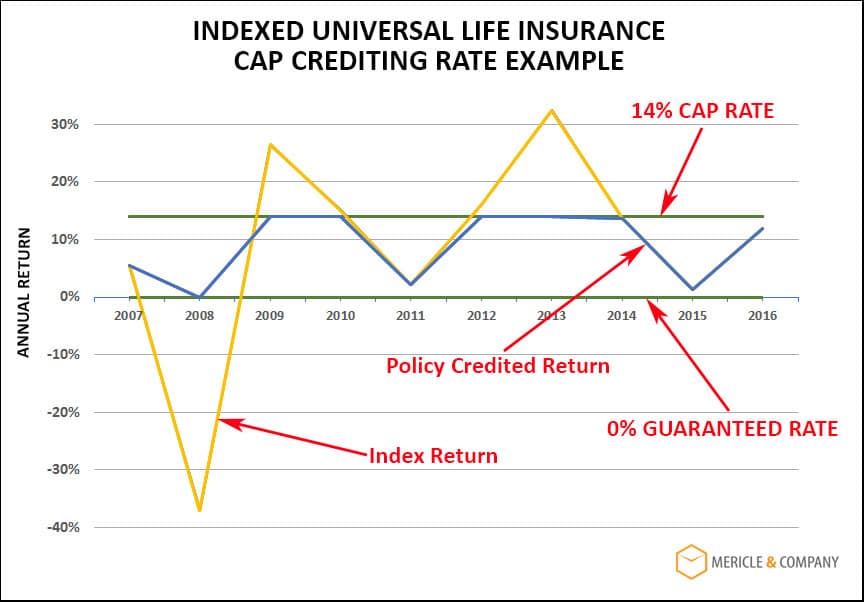

Indexed universal life insurance policy can give a variety of benefits for insurance policy holders, including adaptable costs settlements and the prospective to earn greater returns. Nonetheless, the returns are restricted by caps on gains, and there are no guarantees on the marketplace performance. All in all, IUL policies provide a number of possible benefits, but it is vital to recognize their risks also.

Life is not worth it for the majority of individuals. It has the possibility for large financial investment gains but can be unpredictable and costly contrasted to conventional investing. Additionally, returns on IUL are normally reduced with substantial charges and no assurances - Indexed Universal Life accumulation. Generally, it relies on your demands and goals (Guaranteed Indexed Universal Life). For those seeking foreseeable long-lasting financial savings and ensured death advantages, entire life may be the better option.

What is Iul Companies?

The benefits of an Indexed Universal Life (IUL) plan consist of possible greater returns, no disadvantage danger from market activities, defense, adaptable settlements, no age need, tax-free death advantage, and car loan availability. An IUL policy is permanent and supplies cash value development via an equity index account. Universal life insurance coverage began in 1979 in the United States of America.

By the end of 1983, all significant American life insurance providers provided universal life insurance policy. In 1997, the life insurance company, Transamerica, presented indexed universal life insurance policy which offered insurance holders the capability to connect policy growth with worldwide stock exchange returns. Today, universal life, or UL as it is additionally recognized comes in a range of various forms and is a huge part of the life insurance coverage market.

The details supplied in this article is for educational and informational objectives only and should not be construed as economic or financial investment guidance. While the author possesses expertise in the topic, visitors are advised to speak with a qualified monetary consultant before making any investment choices or buying any type of life insurance coverage products.

What should I know before getting Indexed Universal Life Vs Term Life?

As a matter of fact, you may not have thought a lot about exactly how you wish to invest your retired life years, though you probably understand that you don't intend to run out of cash and you want to maintain your current lifestyle. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text appears alongside the company man talking to the electronic camera that reads "company pension", "social protection" and "financial savings"./ wp-end-tag > In the past, individuals depended on three main sources of earnings in their retired life: a business pension plan, Social Security and whatever they 'd taken care of to conserve

Less employers are using typical pension strategies. Also if advantages have not been reduced by the time you retire, Social Security alone was never meant to be sufficient to pay for the way of life you desire and are worthy of.

Prior to dedicating to indexed universal life insurance policy, below are some advantages and disadvantages to take into consideration. If you select an excellent indexed universal life insurance coverage plan, you may see your cash worth expand in value. This is helpful since you may have the ability to access this cash prior to the strategy expires.

Is Tax-advantaged Indexed Universal Life worth it?

If you can access it early, it may be useful to factor it into your. Given that indexed global life insurance coverage needs a particular level of threat, insurance policy business often tend to maintain 6. This kind of plan likewise offers. It is still assured, and you can readjust the face amount and riders over time7.

If the selected index doesn't perform well, your money worth's growth will certainly be influenced. Normally, the insurance provider has a beneficial interest in doing better than the index11. There is generally a guaranteed minimum interest rate, so your strategy's growth will not drop below a particular percentage12. These are all aspects to be considered when selecting the most effective sort of life insurance for you.

Considering that this type of plan is more complex and has a financial investment element, it can commonly come with greater premiums than other plans like whole life or term life insurance policy. If you do not assume indexed universal life insurance policy is right for you, right here are some options to think about: Term life insurance policy is a momentary policy that commonly offers coverage for 10 to three decades

Latest Posts

Universal Life Cash Surrender Value

Benefits Of Iul Insurance

Nationwide Yourlife Indexed Ul Accumulator